Why do I have to register for VAT? By Andrew Fraser, Harper MacLeod

Franchise Agreements often contain an obligation on a Franchisee to register their business for VAT and remain registered throughout the duration of the Franchise Agreement. Some Agreements go as far as making any failure to comply with this clause an event which allows the Franchisor to terminate the Franchise Agreement. But why is this clause present? And why do Franchisors force franchisees (whose turnover is beneath the registration threshold) to register their business for VAT?

The Trading Schemes Act 1996

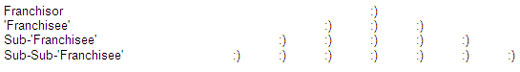

Put simply, the answer is to avoid the application of the Trading Schemes Act 1996 to the Franchise System. This Act has often been considered the thorn in the side of ethical businesses that are hoping to expand via franchising. It was brought in to regulate the problems associated with 'pyramid selling'. The problem being that the “franchisees” of a pyramid scheme are either directly encouraged to or discover on their own that it is it more remunerative for them to find other sub-franchisees than to sell the goods or services that they are supposed to. In turn, these new recruits or “Sub-franchisees’ also are told or figure out that they can make more money by recruiting their own sub-sub-franchisees. This forms a pyramid like this:

These relationships are legal but are very heavily regulated by the Trading Schemes Act and the associated Trading Scheme Regulations 1997.

What’s the problem for Franchisors?

The problem is that the Act is very broad and generally all franchise relationships will be regarded as trading schemes under the Act (with limited exceptions). If the Franchisor doesn’t comply with the provisions of the Act he may face criminal prosecution. As such, any trading scheme must follow the Trading Scheme Regulations 1997 to the letter. These regulations are onerous and, in particular, impose tight controls relating to advertising, contractual provisions and cooling off periods which are unattractive to Franchisors

So why do I have to be VAT registered?

There are two main exceptions to the Trading Schemes Act which enable the Franchisor to avoid the regulations mentioned above. These are:

1. The franchise operates only on a single tier (i.e. not multi-level) systems. For example:

Or;

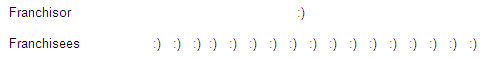

2. All UK based franchisees are, and remain, registered for VAT. For example:

With this in mind, it is clear why the Franchisor requires VAT registration. However, if the Franchisor is only operating on a single tier (as in the first exception above) then VAT registration may not be required. We would recommend discussing this point with your Franchisor.

Andrew Fraser

Andrew is a solicitor who acts on behalf of franchisors and franchisees throughout the UK and Internationally on all manner of franchising issues including franchising businesses, buying and selling franchised businesses and managing franchise disputes.

Prior to joining Harper Macleod, Andrew was a Franchise Consultant with one of the UK’s leading franchise consultancy practices helping businesses to grow through franchising; existing franchisors to improve and expand their networks; and working with large retailers to franchise internationally. He has worked with a wide range of clients from sole traders to global companies, such as Ralph Lauren, Esprit and American Eagle Outfitters.